2013 report cover

This year's report will only be available electronically. To save costs, the report is not being printed or mailed to residents.

|

|

2013 State of the County report available

Report on Sublette County, Wyoming only available digitally

October 15, 2013

The 2013 edition of the Sublette County State of the County report is now available. According to Sublette County Clerk Mary Lankford, there will not be a printed and mailed version of this report, as in the past. The report is being made available electronically on the Sublette County website: www.sublettewyo.com. The report researched and written by Cat Urbigkit and graphic design layout done by Sue Sommers.

Highlights:

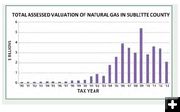

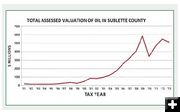

Sublette County’s assessed valuation reached its historic peak in 2009, with a countywide valuation of $6,397,654,034. That number declined by more than half by 2013, at which point the county’s assessed value was $3,022,001,112.

Sublette County contributed 16 percent taxes collected in Wyoming counties second only to Campbell County.

Sublette County’s four-percent sales and tax collection declined 21 percent from Fiscal Year 2012 to Fiscal Year 2013, from $61.7 million to $40.7 million. This amount includes both the state and local shares of the statewide 4 percent sales and use tax collections. Fifty-three percent of collections are retained in the state’s general fund, and the remainder is distributed to local governments (counties and towns).

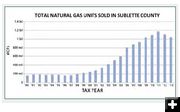

Sublette County was the largest natural producer in the state in 2012, followed Johnson and Sweetwater counties.

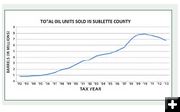

Sublette County ranked third in crude oil production in 2012, Campbell and Park counties.

Sublette County has a budget of more than $202 million. The county operating budget is $59 million. Although the total county budget is $202 million, the county commission allocated only $59 million of that amount to general fund spending accounts. This includes funding for all county departments and county-supported organizations and activities, with the exception of those that have separate mill levy allocations (fair, airport, library, museum, recreation and fire).

Sublette County has nearly $135 million in reserve accounts. The budget includes $134,847,903 in reserve ac¬counts, split between cash ($10 million); equip¬ment ($8.1 million); and depreciation ($116.7 million). Reserve money is held in interest-earn¬ing accounts. In order to be spent, the budget must be amended to transfer the required funding from a reserve account to a spending account.

Property taxes:

All property tax is based on the assessed val¬ue of the property. Assessed value actually means taxable value, which is a percent of the fair market value. Gross product of minerals and mine prod¬ucts is taxed at 100 percent of its fair market value; industrial property is taxed at 11.5 per-cent; and all other property (real and personal) is taxed at 9.5 percent. Sublette County property owners have among the lowest average mill levies in the state, with a total of about 64 mills. The total mills levied in Sublette County includes not only the 12 mills established by the county commission, but also school funding and special districts. Property taxes are one of the primary sourc¬es of funds for local governments, counties, school districts, cities, towns and special agen-cies such as service and improvement districts. The federal government does not receive any revenue from county property tax.

Top 10 Taxpayers in Sublette County:

Company, Total Assessed Value

EnCana Oil & Gas USA, Inc., $733,252,789

Ultra Resources, Inc., 553,073,445

Jonah Gas Gathering Co., 516,666,330

QEP Energy Co., 391,465,911

SWEPI LP, 289,786,107

BP America Production Co., 149,518,296

Lance Oil & Gas Co., Inc., 120,670,930

Exxon Mobil Corp., 51,670,333

EOG Resources, Inc., 49,017,139

Wexpro Co., 46,803,616

TOTAL $2,901,924,896

Valuation by Property Type

Property Class, Assessed Value, Percent

Mineral & Industry, $2,877,203,313, 95.21%

Residential, 98,364,751, 3.25%

Commercial, 30,910,051, 1.02%

Agricultural, 8,189,742, 0.27%

Utilities, 7,333,255, 0.24%

Total $3,022,001,112

How much does it cost Sublette County government to …

Operate for one month: $3.7 million

Change the dirt in the fairgrounds (Ag Center) arena: $30,000, every 3 years

Pave one mile of road: Paving only, $300,000

Complete rebuild and paving, $1 million

Landfill one ton of waste: $34.82

Supply electricity to the courthouse for one month: $5,000

Replace a tire on a road grader: $1,700 without labor

Operate the emergency dispatch center for one month: $66,000

Feed a jail inmate for one day: $35

Maintain a mile of road for a year: $5,000

County Employee Salaries

The county commission sets salaries for elected officials, using the guidance of state statutes that establish salary caps for certain elected positions.

Salaries for the county clerk, treasurer, assessor, clerk of district court, sheriff are set at $82,688. The county attorney’s annual salary is $93,713 year. The county coroner’s salary is set at $29,390.

During the peak of industrial activity in the county, the commission offered a yearly bonus to county employees for retaining their positions with the county instead of pursuing more lucrative jobs in private enterprise. This year, the commission voted to cut the bonus in half, providing a bonus of $200 per year for each year of service, up to five years, with a maximum bonus of $1,000. The commission has pledged that this is the last year the county will offer a bonus. The commission also agreed to cover a small increase in retirement system costs, and provide additional money to the staff health savings account program.

Construction projects:

Sublette Center $6.5 million Construction of independent living facility

Transfer station $500,000 Renovations on building

Boulder Community Center $318,944 Completion of renovations

Daniel Schoolhouse $5,000 Completion of renovations

White Pine Tower $384,367 Construction of a new communications tower building and equipment

Shooting Range $6,969 Carryover to complete improvements at Daniel law-enforcement shooting range

Local revenues

The Sublette County budget includes a wide variety of local revenue sources. The new budget includes $700,000 in inter¬est revenue from investment of county funds.

The county receives $150,000 in tipping fees at the landfill, $50,000 for recycling materi¬als, and $75,000 from fees at the Pinedale trash transfer station.

Motor vehicle fees are expected to generate $700,000. The county attorney’s office will re-ceive about $47,000 in state grant funding for Victim Witness Services, while the county will also receive $30,000 for emergency manage¬ment efforts from the State of Wyoming.

Federal grant funding of $500,000 is ex¬pected to pass through the county coffers for air quality concerns, as well as $52,000 in state funding for the Temporary Assistance for Needy Families program.

Revenues include more than $1 million in other grant support for specific programs and projects, including those that address bioterror¬ism, homeland security, health issues, and reno-vations at the Boulder Community Center.

Liquor license fees will generate about $7,500, traffic school will bring $24,200, and the county will receive $13,548 for providing law-enforcement services at nearby U.S. Forest Service installations.

An electronic copy of the report is available here: 2013 State of Sublette County Report (2.53MB, 24 pages)

|