State of the County Report 2017-2018

Sublette County, Wyoming

October 20, 2017

The Sublette County Commissioners have released their 2017-2018 State of the County Report. A PDF of the report can be found here: 2017-2017 Sublette County Report

Your Tax Dollars at Work: 2017-2018 Report

A Guide to the Sublette County Budget

Report from the Sublette Board of County Commissioners, Pinedale, Wyoming

FAST FACTS

• Sublette County is only five percent of Wyoming’s landmass, but it contributes nearly 18 percent of the total mineral taxable valuation in the state.

• Sublette County remains Wyoming’s top natural gas producing county, and is third in crude oil production.

• Sublette County’s population dropped nearly five percent from 2010 to 2016, with an estimated 9,769 residents in July 2016.

• With nearly 5,000 square miles, Sublette County has two people per square mile.

• Four of every five acres in Sublette County is owned by government (local, state, or federal).

• Nearly 40 percent of federal land in Sublette County is designated as wilderness or wilderness study area.

• Sublette County consists of 3.1 million acres, of which 19 percent (600,626) is private land.

• Ninety-two percent of private land in Sublette County is in agricultural operations.

• Fourteen percent of private land in Sublette County is under protective conservation easements.

• Of the 23 counties in Wyoming, Campbell, Sweetwater and Sublette counties ranked first, second and third in the highest overall taxable valuations in the state in 2016, as well as the highest percentages of all taxes contributed by each county in Wyoming. Sublette County represented nearly 11 percent of the state’s taxable valuation, and 10 percent of all taxes.

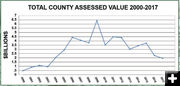

• Sublette County’s assessed valuation reached its historic peak of $6.4 billion in 2009. That number declined 70 percent by 2017, at which point the county’s assessed value was $1.9 billion.

• Sublette County government employs about 160 people.

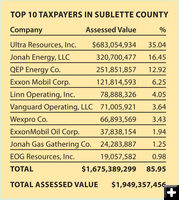

TOP 10 TAXPAYERS IN SUBLETTE COUNTY

Ultra Resources, Inc., Assessed Value $683,054,934, 35.04%

Jonah Energy, LLC, Assessed Value $320,700,477, 16.45%

QEP Energy Co., Assessed Value $251,851,857, 12.92%

Exxon Mobil Corp., Assessed Value $121,814,593, 6.25%

Linn Operating, Inc., Assessed Value $78,888,326, 4.05%

Vanguard Operating, LLC, Assessed Value $71,005,921, 3.64%

Wexpro Co., Assessed Value $66,893,569, 3.43%

ExxonMobil Oil Corp., Assessed Value $37,838,154, 1.94%

Jonah Gas Gathering Co., Assessed Value $24,283,887, 1.25%

EOG Resources, Inc., Assessed Value $19,057,582, 0.98%

TOTA L $1,675,389,299, 85.95%

TOTAL ASSESSED VALUE $1,949,357,456

Commission Sets Operating Budget at $41.7 million

The Sublette County Commission’s efforts to reduce county government spending has resulted in a drop from the $59 million operating budget of three years ago to $41.7 million in the new fiscal year.

Commissioners began this budget cycle asking for departments to decrease their funding requests or at least hold the line on spending to last year’s levels.

Commission Chairman Andy Nelson said, "We’re hoping we’re at the bottom of the pendulum swing. I think we’ve got another year or two before we see the light, so we’ve got to hold pretty tight where we’re at right now."

With three new commissioners on the five-man commission, the budget process made for a grueling two months as the commission considered funding requests amid what Commissioner Mack Rawhouser called "a steep learning curve."

ROAD & BRIDGE

The county’s largest departmental budget is that of the Road & Bridge, generating prolonged discussion among commissioners. Commissioner Joel Bousman noted that traditionally, county roads have been the top priority for county government, and that the county needs to meet the public obligation for good roads. Nelson agreed, noting, "If there is one thing in this county that every constituent uses, it’s roads."

After a winter of record snow levels leading to prolonged spring flooding throughout the county, R&B was swamped with snow removal and damage repairs throughout the county’s nearly 500 miles of roads. On top of that, R&B found itself without a crew for its gravel crusher, with very little crushed material stockpiled.

Commissioner Tom Noble keyed on R&B operations, pushing for insights to personnel and equipment needs to meet maintenance demands. At the time of the budget discussions, R&B was authorized for 19 laborers, but had only 16 positions filled – a steep decline from FY2013’s 24 positions. Even with decreased staff, the county had increased the department’s workload by having R&B perform maintenance work on a variety of county vehicles (including law enforcement and fire department vehicles), as well as equipment work at the fairgrounds and 4-H buildings.

"They need additional resources," Bousman said. The commission agreed to return the department to 24 laborer positions, and urged the department to get the crusher back into operation as soon as possible. Commissioner David Burnett noted that although the commission’s budget approval includes $2.4 million for heavy equipment, and $5 million for projects, the commission retains oversight for any future spending from these line items.

2018 Budget Compared to Last Year

• Operating budget is $500,000 more.

• Cash & revenue is up by $2.4 million.

• Equipment reserve is $800,000 more.

• Depreciation reserve is $2.5 million less.

• General fund budget is $700,000 less

OTHER CHANGES

As the commission budget considerations proceeded, it became apparent that not only would R&B require additional staff, personnel changes were needed in a few other departments. As Nelson lamented the end to the county’s hiring freeze, Burnett pointed out that in several cases, the county was not increasing the number of staff, but adding benefits to existing positions to adequately compensate staff that had previously been classified as temporary.

In the final tally, the county’s operating budget is about $500,000 more than last year. The increase originates in six major areas:

• An increase from three to five commissioners;

• Needed maintenance projects in the Courthouse & Maintenance budget;

• Security doors replacement in the detention center;

• Increased staff, equipment, and projects for Road & Bridge;

• Engineering fees for the landfill; and changes in management for the ice arena

Assistance to Towns

During the natural gas boom years, the county invested heavily in traditional infrastructure projects such as major road improvements and the courthouse complex building project, as well as other major facilities improvements at the county fairgrounds, airports, golf course, ambulance barns, and libraries, in addition to construction of new medical clinics and senior citizen facilities in both Pinedale and Marbleton, and the ag center near Marbleton.

Recognizing that the incorporated towns in the county were also heavily impacted by growth, the county took the unprecedented step of establishing joint powers boards with each of the county’s three incorporated towns in order to allocate some of the county’s general mill levy funding to assist towns in their own infrastructure needs. Each of the three towns received $11 million from this program, in addition to millions of dollars in matching funds for other infrastructure projects. Although the program was discontinued in FY2013, the county continues to assist the towns by providing both law enforcement and fire protection services without charge. All other counties in Wyoming have metro police departments, with the exception of Sublette County.

The purpose of the budget reserve is to leave designated Depreciation Reserves intact while having funding available for budget shortfalls. That effort paid off, as this year the commission dipped into those reserve accounts for the first time, withdrawing $2.5 million to balance the budget, while retaining $168.4 million in reserves.

Commission Chairman Andy Nelson noted, "If money stopped coming in today, county government can continue to function for about five years."

Budget by the Numbers:

$41.7 Million for Operations

The second largest budget in Sublette County’s history rings in at $223 million, and is based on a taxation rate of 12 mills. It is important to note that the budget includes:

Cash-carryover of $8.8 million (numerous departmental budgets were underspent last year, despite imposed budget cuts);

Reserve accounts of $168.4 million; and an Operating budget of $41.7 million. The Fiscal Year 2018 budget covers county income and expenditures from July 1, 2017 through June 30, 2018.

General Fund: $41.7 million

Reserve Accounts: $168.3 million

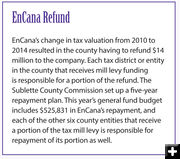

EnCana Tax Refund: $525,831

Fair, Airport, Library, Museum: $12.4 million

Total Requirement: $223 million

Reserve Accounts

Although state officials have a permanent mineral trust fund that allows the interest generated from the account to be spent while preserving its principal, local governments have no similar ability to establish a trust fund. Not only are counties lacking the ability to establish permanent accounts, legal precedent has determined that a sitting commission cannot bind a future commission.

With this reality, the Sublette County Commission worked for more than a decade to establish and build reserve accounts for future needs. The reserve accounts are for specific purposes, covering both operations and capital construction needs.

The current county budget includes $168,394,375 in reserve accounts, split between cash ($10 million); equipment ($11.6 million); and depreciation ($146.7 million). Reserve money is held in interest-earning accounts. In order to be spent, the budget must be amended to transfer the required funding from a reserve account to a spending account.

Cash reserve: $10 million. This money provides for cash flow for county government operations.

Equipment reserve: $11.6 million. Each year, money is set aside to pay for future equipment purchases.

Depreciation reserve: $146.7 million. Since the county does not have the statutory authority to establish a trust fund or rainy day account for future county needs, money is earmarked and set aside in specific reserve accounts for use in the future

The Depreciation Reserve budget includes the following accounts:

Building projects, equipment and maintenance - $32.4 million

Budget Reserve - $14.6 million

Ag & Fair (operations and capital) - $13.1 million

Recreation (operations and capital) - $11.7 million

Library (operations and capital) - $12.2 million

Senior centers/facilities (operations and capital) - $9.7 million

Road & bridge projects - $7 million

Courthouse & maintenance - $7 million

State/County road fund - $6.7 million

Landfill (remediation, closure, reserve) - $5.5 million

Museums - $5.5 million

Airports - $5 million

Human services - $4.5 million

Communications & IT - $3 million

Fire Halls - $3 million

Tax Refunds - $2 million

Resource monitoring - $2 million

Emergency Revolving Loan - $1 million

Rural Health Care District - $364,219

Elections - $200,000

TAPPING RESERVES

Ten years ago, Sublette County was the center of a major natural gas boom, with an increasing workforce and population, and a corresponding demand for services. County government increased to meet those demands, from basic services such as fire protection, law enforcement, and road maintenance, to overall staffing levels in offices issuing building permits, vehicle titles and registrations, etc.

But by 2009, the commission knew the county was set for an economic downturn and began belt-tightening and streamlining county government, implementing a hiring freeze, and prohibiting funding for new human service agencies or programs. After holding the line on spending for a few years, and eventually cutting spending across the board, prudent management by the commission allowed the county to continue to add money to the reserve accounts even as revenues declined.

In FY2015, the commission established a Budget Reserve within its Depreciation Reserve accounts.

The purpose of the budget reserve is to leave designated Depreciation Reserves intact while having funding available for budget shortfalls. That effort paid off, as this year the commission dipped into those reserve accounts for the first time, withdrawing $2.5 million to balance the budget, while retaining $168.4 million in reserves. Commission Chairman Andy Nelson noted, "If money stopped coming in today, county government can continue to function for about five years."

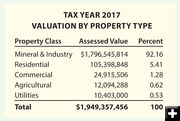

Property Taxation

Property taxes are one of the primary sources of income for local governments, counties, school districts, and other special districts like the Rural Health Care District. The federal government does not receive any revenue from your property tax.

The county assessor establishes taxable values for most properties within the county, subject to final approval and certification by the State of Wyoming.

Mineral production is also valued by state officials for ad valorem and severance tax purposes

.

The Sublette County Commission has set the general fund mill levy at the full 12 mills allowed by law. A mill is $1 of revenue for every $1,000 of assessed valuation. With minerals accounting for 93 percent of the county’s valuation, the commission’s decision to tax at the full 12-mill rate allows the county to capture this revenue stream while these natural resources are being extracted. Minerals are taxed at a rate of 100 percent of fair market value, but are taxed only once – as they are extracted.

Wyoming statutes require all property to be valued at fair market value, except for agricultural land, which is valued by its productive capability. The county assessor determines the fair market value for homes and property, and takes 9.5 percent of that value to determine the taxable or assessed value of residential homes and real property (11.5 percent for industrial property). The taxable value is then multiplied by the appropriate mill levy, whereby each mill is equal to one-thousandth of the taxable value.

For example, a home with a fair market value of $200,000 would have a taxable value of $19,000 (based on the 9.5 percent residential assessment rate). An assessment of 64 mills on this home (the average mill levy in Sublette County) would result in a tax of $1,216.Although the county taxes 12 mills for county government, your property tax notice includes tax rates ranging from 59 to 67 mills, depending upon where your property is located in the county. A variety of special tax districts impose additional taxation upon property owners in those districts. These special tax districts range from cemetery districts to road improvement districts in areas where property owners vote to approve these taxes on themselves.

The majority of the taxes you pay provides for the state’s educational system. The tax is collected here at the local level, but the revenue is remitted to the state for redistribution

Understanding Revenues

The revenue generated by the taxing of 12 mills provides the majority of funding for county government services, but the budget also includes $14.6 million in revenue from a variety of other sources (federal, state, and local).

Federal Revenuez

The county will receive $542,000 in Federal Payment In Lieu of Taxes. PILT payments were established by Congress in the mid-1970s to reimburse western counties for a portion of the costs associated with having federal land in the county, but with no method for the counties to tax for the services the counties provide.

State Revenues

Several sources of revenue are funneled to the counties from the state, including severance taxes, sales and use taxes, fuel taxes, and others.

• Severance

Mineral severance tax distributions are made to local governments, the state’s water development fund, Wyoming Department of Transportation, and the University of Wyoming. The Sublette County budget includes $149,000 in severance tax revenues.

• Sales & Use

Sublette County’s sales tax rate is four percent, the lowest allowable under statute. Sublette County estimates it will receive $5 million in sales and use taxes this year.

• Gas & Diesel Fuels

Sublette County anticipates receiving $1.1 million from the diesel fuel tax, and $650,000 from the gas tax.

• County Road Fun

The County Road Fund (once known as the Farm To Market program) was originally designed to help counties with road construction needs. Funds allocated under the CRF program may be used for both road construction and maintenance. The CRF is funded by the state through gasoline and severance taxes, using a formula for distribution. Sublette County estimates it will receive $568,000 in county road funds this year.

• Cigarette

Sublette County estimates it will receive $5,000 in cigarette tax revenue in this budget year.

• Lottery

Sublette County will receive $26,000 from the state lottery program.

Local Revenues

The Sublette County budget includes a variety of local revenue sources – from fees paid to county departments, to interest on invested funds.

Motor vehicle licensing will generate $650,000; and revenues earned for recycling, combined with fees paid at the transfer station and landfill, will result in $102,000 in revenue. Plat reviews will generate $2,000, while charges associated with the jail phone and commissary will generate $10,000 for the county. Liquor license fees will generate about $7,300; $10,000 from traffic school; and the county will receive $11,000 for providing law-enforcement services at nearby U.S. Forest Service installations.

The new budget includes $850,000 in interest revenue from investment of county funds.

Revenue from local fees include those paid to the following departments:

County Clerk - $175,000

District Court - $25,000

Planning & Zoning - $8,000

Sanitarian - $4,000

Sheriff - $25,000

Ice Arena - $14,000

Fairgrounds - $25,000

Misc. Fees - $65,000

Grants

The county attorney’s office will receive about $36,000 from Victim Witness Services, while the county will also receive $30,000 for emergency management efforts and $138,000 in support for the county attorney’s office from the State of Wyoming. Federal and state grant funding of more than $650,000 is expected to pass through the county coffers for specific programs and projects, including those hat address bioterrorism, homeland security, air quality, and health issues.

Other Revenues

The budget includes $70,000 the county treasurer retains for collection of sales and use taxes; $40,000 in revenue for fees for services from the public health office; and $10,000 in sales tax penalties. A handful of other miscellaneous smaller revenue streams are expected to generate an additional $80,000.

The Sublette County Rural Health Care District will pay the county $100,000 for lease of the medical clinics (which the county then uses to maintain the facilities), and the Sublette Center will pay $60,000 on a loan received from the county. The LaBarge landfill will pay the county $40,000 for accepting refuse from that community.

The budget also includes a $402,000 carryover in consensus funding for Big Piney’s infrastructure projects from the State of Wyoming

Elected Officials and Their Departments

Commission: $306,100

The Board of County Commissioners is the general administrative body for county government. Commissioners have myriad responsibilities that include making decisions to keep the county a better place to live and work.

Individual commissioners have no power to act independently. All formal and official actions taken by the Board of County Commissioners must be by majority or unanimous vote in a public meeting. Commissioners also appoint department heads of offices for which they have responsibility. They appoint members to a variety of volunteer boards and commissions. Additionally, individual commissioners serve on other boards that serve the interests of county citizens.

The county commission budget rings in at $306,100 this year, a steep jump from last year’s spending of $193,000. The increase is a reflection of the first full year of the commission’s structure changing from three to five commissioners, with annual salaries of $32,500 each, plus additional pay for extra meetings held throughout the year. Commission salaries and pay for meetings total $174,500, with another $11,000 budgeted for meals and mileage.

Fees for special attorneys are allocated $75,000, the same amount that was budgeted last year, although only about $20,000 of that amount was spent. The commission uses specialized attorneys for oil and gas taxation disputes, public lands litigation, etc.

Consultant expenses are allocated $25,000. This amount covers costs associated with production of the State of the County report, as well as consultations with natural resource professionals who provide data or special expertise on various issues at the commission’s direction.

The budget includes $10,000 for possible expenses associated with Commissioner Joel Bousman’s role as president of the National Association of Counties Western Interstate Region, which represents county interests on public policy issues affecting the West. The commission budget also includes $10,100 for a new vehicle reserve, and $500 for office supplies

How Much Are County Officials Paid?

The county commission sets salaries for elected officials every four years, using the guidance of state statutes that establish salary caps for certain elected positions. Sublette County salaries for clerk, treasurer, assessor, clerk of district court, and sheriff are set at $92,908.

The county attorney’s annual salary is $100,000 per year. The county coroner’s salary is set at $30,272. Salaries for other county employees are set by salary schedules approved by the county commission. While eligible employees may move up the pay schedule, the commission has not approved raises or cost-of-living increases for three years

Clerk - $342,362

County Clerk Mary Lankford oversees a staff of three deputy clerks and a departmental budget of $342,362. Most of the anticipated expenditures for this department cover staff salaries totaling $325,000, including the hiring of a fourth deputy. Remaining budget items cover general office operations.

The duties of the county clerk are diverse and are established by state statute. The county clerk serves as the clerk for the board of county commissioners, preparing agendas, and preparing and recording minutes, resolutions and agreements for the commission. As the chief budget officer for the county, the clerk prepares the budget for adoption by the commissions, and then administers the adopted budget. This process requires working closely with each department as well as with the commission itself.

The clerk’s office issues marriage licenses and titles and liens for motor vehicles, administers liquor license applications and records, and maintains official records of land transactions, subdivisions, mineral leases, and mining claims.

The clerk’s office is the accounting office for the county, processing payment requests from vendors to the county, as well as handling the financial administration of grants paid to the county.

The clerk’s office also serves as county government’s personnel office, maintaining general personnel records, providing new employee orientation and policy manuals, and processing and paying county payroll and benefit allocations.

Assessor - $484,774

The majority of Assessor Jeness Saxton’s nearly $485,000 budget covers $391,000 in personnel costs associated with the assessor and her five deputies, and the $75,000 cost of a contract for industrial appraisal and audit services. The budget includes $6,000 for a new vehicle reserve, while the balance of the budget covers the costs of office operations.

The assessor’s office locates, identifies, and values all taxable property in the county in accordance with state laws and guidelines. In Sublette County, that covers more than 10,000 individual parcels.

Treasurer - $279,706

Treasurer Roxanna Jensen’s $280,000 budget holds the line on spending to last year’s level, with the bulk of that amount ($257,000) covering personnel costs for Jensen and her three full-time deputies as well as one part-time position. The remainder of budgeted expenditures covers general office operations.

The treasurer’s office is responsible for vehicle registrations, sales and property tax collections, and maintaining the books for Sublette County’s government.

Attorney - $741,370

County Attorney Clayton Kainer’s $741K budget shows a decrease from last year’s budget, but is allocated at a higher level than this department’s actual expenditures last year. The main differences include $60,000 budgeted for prosecution and defense, of which only $20,000 was spent last year, but these costs are difficult to predict from year to year; $36,000 is allocated for the crime victims program, of which just $2,300 was spent last year.

The majority of this department’s budget covers personnel costs for the county attorney, deputy attorneys, and secretaries, totaling $531,000. The Title 25 program is allocated $60,000, which provides for emergency and involuntary hospitalizations of persons suffering from mental illness. The remainder of the budget covers general costs associated with operating the county law offices.

In a separate general fund line item, the county pays $12,000 for office rental for the public defender.

District Court - $359,191

District Court Clerk Janet Montgomery’s $359K budget is similar to last year’s, with the majority of that amount ($223,000) allocated to personnel costs associated with the clerk of court, her two full-time deputies, and one part-time project employee in charge of digitizing court records. The budget also includes $90,000 for the public defender program, $8,000 for court-appointed attorneys, and $8,000 for jurors and witness fees, while the balance covers general operations of the district court clerk’s office. The district court clerk is responsible for maintain-ing and preserving the records for all cases filed with the Ninth Judicial District Court, including the processing of cases and court-ordered payments as well as the administration of appeals and jury trials. The district court hears felony criminal cases, large civil cases, juvenile, and probate matters – the most serious legal cases and controversies in the state.

Coroner - $58,072

The bulk of Coroner Curt Covill’s $58K budget covers the coroner’s salary as well as standby time for deputy coroners. Other major items include $7,750 for a new vehicle reserve, $8,000 for autopsies, $4,000 for supplies, $2,000 for county burials, and lesser amounts for training and vehicle expenses.

The coroner is charged with pronouncing death and determining the time of death, identifying and removing the deceased, determining the need for autopsy, notifying the next-of-kin, and completing death certificates, as well as investigating deaths in a variety of circumstances.

Sheriff ’s Office - $8 million

Sheriff K.C. Lehr supervises five budgets with a combined total of just over $8 million.

Law Enforcement - $4,050,280

Detention - $2,305,785

Communications - $871,823

Search & Rescue - $651,350

Emergency Mgmt - $152,755

Total $8,031,993

The $4 million Law Enforcement budget includes $2.8 million in personnel costs for 33 law enforcement officers and four clerical staff. New vehicle purchases are budgeted $350,000 while another $150,000 is put into the new vehicle reserve. Tires, gas, oil and maintenance costs are estimated at $210,000.

Criminal investigations are allocated $62,000, patrol equipment $65,000, investigation equipment $49,000, and ammunition $60,000. Training, medical expenses and uniforms for officers are estimated at a combined $66,000. Animal control is budgeted $36,700.

Radio maintenance, utilities and telephone total $111,000.

Detention’s budget of $2.3 million includes $1.74 million in personnel costs for the 27 staff working in the county jail and providing courtroom security. Major costs include $280,000 for prisoners’ board, $100,000 for prisoners’ medical expenses, and $50,000 for specialized maintenance on the 13-year-old jail. Also in-ed in the budget is $45,000 for computer systems and equipment, $23,000 for training for detention staff, and $10,000 for uniforms.

The $871,823 Communications budget covers the costs associated with the county dispatch center, with just under $595,000 of that as personnel costs for the nine employees working in the dispatch center. Other major line items include $193,000 for maintenance agreement contracts for the communications technology, $31,500 for the E-911 calling service, $20,000 in a 911 equipment reserve, and $12,000 for staff training.

Search & Rescue’s $651,350 budget includes a $392,095 helicopter contract that accounts for more than half of this program’s budget. Search & Rescue also provides training and equipment for use by Tip Top Search & Rescue volunteers. The county pays $68,055 for the administrator’s salary. Training is allocated $65,000, while search operations are budgeted $28,000. Equipment purchases totaling $17,000 are budgeted for swiftwater, ATV and high angle use. Reserves for new equipment and vehicles are budgeted $33,000. The remaining budget items cover office operations and maintenance of vehicles.

Major expenditures in the $152,755 Emergency Management budget include $68,055 for the coordinator’s salary, $45,000 for new vehicle and small equipment reserves, and $12,500 for telephone services, including land lines, cellular, and satellite services. Gas, oil, and vehicle maintenance costs are estimated at $9,000, while utilities are allocated $6,000. All remaining budget items reach a combined total of $12,200

Other County Departments

Road & Bridge - $12.9 million

The $12.9 million road and bridge department budget is a large increase over last year’s R&B spending of $6.9 million. R&B Superintendent Butch Penton reports directly to the Sublette County Commission, which provides oversight to this largest of the county departments.

The heftiest line items in this budget are $5 million allocated to road projects, heavy equipment purchases budgeted at $2.4 million, and personnel costs of $2.16 million. Although the commission allocated these large amounts for equipment and projects, the commission retains authority for specific purchases or project funding. The commission also approved $500,000 for the heavy equipment reserve account.

Soil stabilizer (mag water) is allocated $600,000, a portion of which is reimbursed by a federal air quality grant. Gas, oil, parts, repairs, and tires are budgeted a combined $1.4 million. Material costs (culverts, cattle guards, etc.) are estimated at $410,000, crusher costs are budgeted $100,000, and gravel purchase is estimated at $100,000. Utilities, telephone and radio maintenance are budgeted $122,000.

Waste Management - $1.41 million

Sublette County’s Waste Management department consists of three major program areas: landfill, transfer station, and recycling, with a combined budget of $1.41 million.

The general waste management budget totaling over $1 million covers costs associated with operating the balefill facility and sanitary landfill near Marbleton.

This budget is up substantially from last year because of increases in three major line items: $70,000 for heavy equipment purchases, $75,000 for heavy equipment reserves, and $150,000 for engineering fees. Baler operations are budgeted $75,000, while water monitoring is estimated at $40,000, and environmental bags for the refuse bales are allocated $30,000. Gas, oil, repairs, and tire costs are estimated at $95,000.Personnel costs ring in at $422,000 for five full-time positions, while utilities and telephone are estimated at $61,000.

The county trash transfer station near Pinedale has a $326,343 budget. Two major line items constitute the transfer station budget: a $220,000 contract for transportation of refuse to the landfill, and $83,093 in personnel costs.

The $62,347 recycling budget remains unchanged from last year, with personnel costs the largest line item at $37,597. Transportation, gas, oil, supplies and utilities are other lesser line items in this budget.

Courthouse & Maintenance - $2.76 million

Maintenance Superintendent Andre Irey’s $2.76 million budget provides for maintenance and janitorial services for most of county-owned buildings, as well as snowplowing and landscaping. Irey reports directly to the commission. Personnel costs for Irey and his 20 staff members total $1.3 million, and insurance on the buildings is allocated $475,000. Maintenance and improvements to county buildings other than the courthouse (such as the library, visitor center, sidewalks, etc.) are allocated $400,000. Building supplies such as lights, light bulbs and paint are budgeted $150,000, while janitorial supplies, equipment and tools are allocated $75,000. Utilities are estimated at $150,000, while vehicle maintenance, gas and oil are budgeted $50,000.

Maintenance on the medical clinics is allocated $100,000, and costs associated with the 4-H barn outside of Pinedale are estimated at about $45,000.

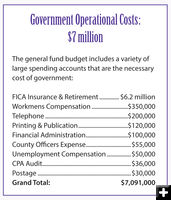

Government Operational Costs: $7 million

The general fund budget includes a variety of large spending accounts that are the necessary cost of government:

FICA Insurance & Retirement - $6.2 million

Workmens Compensation - $350,000

Telephone - $200,000

Printing & Publication - $120,000

Financial Administration - $100,000

County Officers Expense - $55,000

Unemployment Compensation - $50,000

CPA Audit - $36,000

Postage - $30,000

Grand Total: $7,091,000

Planning & Zoning - $10,150

With the sudden and tragic death of long-time county planner Bart Myers in June 2017, the county commission did not approve full funding for this department until a new planner has been hired. Instead, the commission allocated just over $10,000 to cover necessary office functions until a full budget can be developed.

Public Health - $334,967

The public health office includes two and a half state-funded nursing positions, while the county provides the office, equipment, clerical and one half of a nursing position. The $334,967 budget is a decrease from last year, and includes $152,000 in personnel costs, with other major budget items including $50,000 for vaccines, $15,000 for health fairs, and $12,000 for janitorial services. The budget also includes numerous expenditures for local preparedness programs that are funded through grants, including $80,000 for bioterrorism, and $2,000 for Ebola.

Treatment Court - $208,607

The $208K treatment court budget has decreased slightly from last year, and includes $50,857 in salary for coordinator Kathy Anderson, who works under the supervision of Judge Curt Haws. This court-supervised treatment program serves as an alternative to incarceration or probation for repeat substance-abuse-related offenses. The treatment court budget includes $85,000 for mental health counseling, $55,000 for drug testing, and $5,000 for a magistrate judge. The remaining budget items cover general operations of the program, including team training, and incentives and graduations for participants

Health Officer & Sanitarian - $47,702

The $47K combined budget for the county health officer and sanitarian is unchanged from last year. County Sanitarian Alan Huston conducts food safety and septic system inspections and is paid $28,000.

Dr. J. Thomas Johnston is the county health officer and receives $15,600 in compensation (of which $9,600 is funded through a grant from the state). Although appointed by the county commission, the county health officer works under the direction of the Wyoming Department of Health to investigate communicable diseases, prevent the spread of disease, and promote the health of the citizenry.

Information Technology - $249,050

The $249K IT budget includes $87,550 for the administrator’s salary in this one-man department. Contract services totaling $98,000 provide backup support to the information technology systems for the courthouse complex and sheriff ’s office computer systems.

Major budget items include $30,000 for equipment and supplies, and $20,000 for training, with the balance allocated to general office operations.

GIS - $51,100

The $51,100 Geographic Information System budget includes $45,600 to cover the costs of the county contract with Rich Greenwood to maintain the GIS/map server system available on the county website (www.sublettewyo.com), and $5,000 for consultations or projects, as well as $500 for office supplies. This budget is unchanged from last year.

Surveyor - $12,000

The $12,000 county survey budget covers costs associated with Skylar Wilson’s contract work for the county, which is directed by the county commission.

The primary duty of the county surveyor involves county roads (alignment, rights-of-way, surveying, mapping, legal documents, etc.), boundary surveys of parcels the county intends to acquire, legal property research, land and road investigations, reports, and consultation with other departments on road and property matters. This budget is unchanged from last year.

Elections - $23,600

The $23,600 elections budget is down half from the previous year, a reflection that it is not a year for major elections. The budget includes $17,700 for maintenance of election equipment. The balance consists of small amounts for supplies and notices for minor elections.

Designated Mill Funding - $12.4 million

Six program areas receive a portion of the county’s 12-mill levy established by the county commission because of their special status as determined by state statute, although their level of funding remains at the discretion of the county commission. These boards include: fair, fire, library, museum, airport, and recreation.

The total budget amounts for each of these budgets includes some cash carry-over from the previous budget year, as well as the mill levy allocation from the current year. In most cases, boards appointed by the county commissioners supervise these budgets but the commission approves their final budgets.

Fair - $932,910

Airport - $814,115

Library - $1,605,185

Museum - $352,469

Recreation - $1,394,021

Fire - $7,312,092

Grand Total: $12,410,792

Fair - $932,910

The Sublette County Fair mill levy allocation provides funding for the county fair and the overall fairgrounds operations in separate budgets.

The fair board budget totals $408,500, including the following:

2017 Fair - $155,000

2018 Fair - $167,000

Administrative - $61,000

Reserve - $25,000

The fairgrounds budget is $517,184, and includes $213,684 in personnel costs for Manager Jay Brower and his staff. Brower reports directly to the county commission. Other major line items in the fairgrounds budget include $160,000 in utility and telephone costs; $25,000 for repairs; $27,500 in equipment; $10,000 in a new vehicle reserve; and $25,000 for building maintenance. The budget also includes $15,000 for projects and landscaping, $12,500 for training and travel, and $12,000 for gas and oil.

The Fair budget includes a refund to EnCana totaling $7,226.

A separate allocation of $63,215 remains in the budget for expansion of the county fairgrounds. This is a carryover item from previous budgets and the commission currently has no plans for further expansion of the fairgrounds.

Airport - $814,115

Both airports near Marbleton and Pinedale benefit from county mill levy funding. The Big Piney-Marbleton airport will receive $96,000 for general operations, while the Town of Pinedale’s airport will receive $150,000 for major improvement projects, in addition to $566,109 allocated to reserves for future projects. The county’s contribution to Pinedale is limited to match funding for improvement projects, and not for general operations. This budget also includes $2,006 in EnCana refunds.

Library - $1.6 million

The Sublette County Library system will receive $1.6 million for operations in the Big Piney and Pinedale facilities, in addition to providing circulation materials and support to the seasonal library in Bondurant, operated by volunteers. This allocation includes a $17,713 refund to EnCana.

Museum - $352,469

The museum mill levy funding covers the following budget components:

Green River Valley Museum - $109,428

Museum of the Mountain Man - $194,500

Cash Reserve - $35,386

SC Museum Board - $7,768

EnCana refund - $5,387

These allocations provide support to both museums in the county, as well as other historic preservation and interpretation efforts. In a separate general fund allocation, the county will provide $19,000 to the Sublette County Historic Preservation Board for community history projects, including homestead surveys and national register site documentations.

Recreation - $1,394,021

The recreation mill levy funds the Sublette County Recreation Board, the Ice Arena in Pinedale, and the required EnCana refund.

The majority of Rec Board’s $1 million budget consists of carryover funding of more than $800,000. The rec board budget has declined every year over the last three or four years, and this year’s funding level is similar to the year prior, with funding for recreational projects totaling just over $335,000. Approved projects include lighting for the ball fields, livestock contracts for rodeos, equipment leases for golf course maintenance, maintenance of parks, and support for various programs – from hockey to Nordic trail grooming.

The $341,357 ice arena budget includes $210,867 in personnel costs. The commission is considering hiring a manager for the facility, in hopes of developing the ice arena as a destination/event center to bring more activities and revenues to the facility.

Other major items in the ice arena budget include $75,000 for utilities, $20,000 for building maintenance, and $15,000 for equipment maintenance. The $8,293 EnCana refund will come from this mill levy allocation.

Unified Fire - $7.3 million

The Unified Fire annual operating budget is $2,015,440, and includes $414,374 in personnel and firefighter wages, $423,172 in grant expenditures, $275,594 for apparatus (firetruck) purchase, and $236,000 for facilities maintenance.

Equipment and supplies are allocated $105,000, while utilities and telephone are budgeted $70,000. Physical exams for firefighters are estimated to cost $50,000, while retirement and uniforms are each budgeted $15,000, and $70,000 is set aside for volunteer firefighter insurance. The budget also includes $45,000 for training and $50,000 for wildland fire suppression. Maintenance costs for equipment and apparatus are allocated a total of $156,000.

In addition to the $2 million operations budget, the county holds about $5 million in reserves for replacement of firefighting apparatus, and eventual fire hall improvements or replacements.

The commission also allocated a separate line item of $69,164 for fire suppression. This allocation has strict limitations on its use, and is primarily to pay for fire equipment from neighboring counties to be on standby in years when fire activity is high and local resources are already engaged.

Unified Fire also brings in about $400,000 in revenue, mostly from grants and wildland firefighting.

Support for Human Service Programs: $1.6 million

The Sublette County Commission uses the general fund budget to provide support to a variety of organizations that provide needed services for a diversity of human service programs, including those involving children, senior citizens, and other segments of our citizenry. Support is either provided through direct allocation of funding, or with the county serving as the pass-through agent for grant funding from state programs.

Senior Citizens $935,076

Children $528,592

Other $200,681

Senior Citizens

Sublette Center - $480,000

SW SC Pioneers - $160,076

Rendezvous Pointe - $145,000

Senior facilities - $150,000

The Sublette Center will receive $480,000 in general support for this retirement community that provides both skilled nursing care and independent living for seniors.

Southwest Sublette County Pioneers in Marbleton serves nearly 250 senior citizens annually and will receive just over $160,000 in county funding to continue its meals program along with a wide range of activities and services.

Rendezvous Pointe in Pinedale will receive $145,000 for senior center operations, which serve meals and offer health and wellness programs and other services for senior citizens.

The county commission has also set aside a separate allocation of $150,000 for general maintenance and repairs on senior citizen facilities in the county.

Children

Children’s Learning Center - $219,308

Children’s Discovery Center - $75,000

Pinedale Preschool - $18,860

Scholarships - $104,000

Van Vleck House - $45,000

4-H Afterschool - $36,674

Big Brothers Big Sisters - $29,000

Ready For Workforce - $750

The Children’s Learning Center is the only early childhood program serving the entire county, and providing early special education through the Wyoming Department of Education and early intervention for children from birth to the age of two by the Wyoming Department of Health. Last year the program served 103 children, including 81 with special needs. The county has committed to providing just over $219,000 to this program in the new year.

Children’s Discovery Center in Pinedale is an early education facility operating five days per week and serving children ages two to 10 years old. CDC’s preschool program provided care for 45 families last year. CDC will receive $75,000 from the county general fund.

Pinedale Preschool will receive $18,860 from the county for its preschool program. Older children will receive a boost from the county as well, with $104,000 set aside for scholarships for Sublette County students to attend an institution of higher learning. Up to 26 students will receive the $4,000 scholarships.

The Van Vleck House, operated by Teton Youth & Family Services, will receive $45,000 to provide prevention, early intervention, and treatment to Sublette County youth aged 10 to 18 in its group home, crisis shelter, and secure facilities. Last year, five Sublette County children stayed at the crisis shelter, four were in the group home, and one was housed in the secure facility. Located in Jackson, this program serves youth from Sublette, Teton and Lincoln counties.

The 4-H Afterschool program’s $36,674 consists of carryover funding that the county administers, while the local Board of Cooperative Educational Services handles the program.

Big Brothers, Big Sisters will receive a total of $29,000, with a portion of that funding coming from a state grant, and the remainder from county general funds to provide youth mentoring services.

The Ready For Workforce allocation of $750 is the county’s support for this Sublette Board of Cooperative Educational Services program to provide work experience to students.

Other Human Services

Veteran’s Services - $125,000

SAFV - $46,358

Pregnancy Resource Center - $17,860

Home Based Family Services - $8,463

Community Food Closet - $3,000

The Tri-County Veteran’s Services program is a joint effort with Lincoln and Sweetwater counties to help connect veterans with state and federal benefits – ranging from home loans and educational benefits to health care and disability compensation. Sublette County provides $125,000 to this program.

The Sublette County Sexual Assault/Family Violence Task Force will receive a total of $46,358 in both a direct allocation and as pass-through state funding. The program provides assistance, safety intervention, and prevention education through its 24-hour crisis hotline, emergency shelter and financial assistance, among its other services. The county also provides the buildings for SAFV offices and shelters.

The Pregnancy Resource Center will receive $17,860 in pass-through funding from a state grant. The program provides support to women and families who experience an unplanned pregnancy, or who are parenting young children.

The Home Based Family Services program will receive about $8,500 in pass-through state funding to provide personal care and homemaking services for home-bound citizens.

The Community Food Closet in Big Piney will receive $3,000 in county funding to provide supplemental food assistance to those in need.

Addressing Natural Resource Issues: $840,418

Sublette County’s abundant natural resources and vast public lands require special attention from county government, which addresses issues through a variety of programs.

Conservation District - $625,327

Extension Service - $138,091

Predator Management - $32,000

Coalition of Governments - $30,000

WPLI - $15,000

The Sublette County Conservation District will receive $625,327 for its continued operations, which is the same amount of support the district received last year. The district monitors changes in water quality, works to improve watershed conditions through water development projects, is an active participant in federal and state land use planning, and offers a variety of programs to benefit natural resources in the county, from sponsoring seedling tree sales to rangeland monitoring. Members of the district’s board of supervisors are elected from rural and urban areas of the county. The county provides $138,091 in funding to the University of Wyoming’s County Extension Service programs for 4-H youth development, economics, and information and research related to agriculture and natural resources.

The Sublette County Predator Management District is budgeted to receive $32,000 (the same amount the district received last year) for predator control. Most control efforts involve coyotes, in addition to control of ravens and depredating wolves. This board consists of three elected sheep representatives, three elected cattle representatives, and one member appointed by the county commission.

The Sublette County Commission serves as a member of the Coalition of Governments in south western Wyoming, and provides $30,000 in funding. This coalition of county governments works together to deal with federal land management issues and resource planning projects.

The budget includes $15,000 for the Wyoming Public Lands Initiative, a program of the Wyoming County Commissioners Association. This collaborative effort aims to bring forth one multi-county legislative lands package addressing the designation and management of Wyoming’s wilderness study areas. The Sublette County Commission has appointed an eight-member advisory committee to develop WSA recommendations for the commission’s consideration.

MISCELLANEOUS PROGRAM SUPPORT

Visitor Center - $38,422

Translator Grant - $30,000

Animal Control - $950

The commission agreed to fund the Sublette County Chamber of Commerce with $38,422 for operations of the Visitor Center in Pinedale. County funding for the center’s operations continues to decline each year as the commission struggles with not only providing the building but paying a substantial percentage of its operating cost. The commission noted that the Town of Pinedale receives the most benefit from the center with its location in Pinedale, and yet provides little support.

The $30,000 translator grant is carryover from previous budgets and is used for rural television operations in the county.

Happy Endings Animal Rescue is provided $950 toward the spay-and neuter program for stray pets

Contact the Sublette County Commission

Commission meetings are generally held the first and third Tuesdays of the month, with some variation. Meetings begin at 9 a.m. in the commission meeting room of the county courthouse in Pinedale, and are open to the public. To schedule an appointment to appear on the commission’s meeting agenda, please contact Sublette County Clerk Mary Lankford at (307) 367-4372.

The county’s fiscal year is July 1 to June 30 of each year. Each summer the commissioners set the budget for the coming fiscal year. Funding requests are submitted in May, and the commission holds a series of work sessions through June for the budget discussion and consideration, followed by a budget hearing and formal adoption the third week in July. County commissioners work with all other county elected officials to assure that all offices of county government are properly funded to perform statutory duties.

Sublette County Commission

P.O. Box 250, Pinedale WY 82941

(307) 367-4372

info@sublettewyo.com

www.sublettewyo.com

Commission Chairman

Andy Nelson

andy.nelson@sublettewyo.com

(307) 749-7886

Commission Vice Chairman

Joel Bousman

joel.bousman@sublettewyo.com

(307) 749-6154

Commissioner

David Burnett

david.burnett@sublettewyo.com

(307) 749-2005

Commissioner

Tom Noble

tom.noble@sublettewyo.com

(307) 749-2002

Commissioner

Mack Rawhouser

mack.rawhouser@sublettewyo.com

(307) 749-2007

|