Fourth Quarter Energy Survey

Drilling activity not expected to pick up in the near term

January 10, 2020

The Federal Reserve Bank of Kansas City released the fourth quarter Energy Survey on Friday, Jan. 10, 2020. According to Chad Wilkerson, Oklahoma City Branch executive and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District energy activity dropped further and expectations for future activity continued to decline.

"District energy activity continued to decrease through Q4 2019 and most firms do not expect drilling activity to pick up in the near-term," said Wilkerson. "However, slightly more firms expect their cash flow to be higher next year than expect it to be lower."

The Kansas City Fed's quarterly Tenth District Energy Survey provides information on current and expected activity among energy firms in the Tenth District. The survey monitors oil and gas-related firms located and/or headquartered in the Tenth District, with results based on total firm activity. Survey results reveal changes in several indicators of energy activity, including drilling, capital spending, and employment. Firms also indicate projections for oil and gas prices. All results are diffusion indexes – the percentage of firms indicating increases minus the percentage of firms indicating decreases. Results from current and past surveys and release dates for future surveys can be found at https://www.kansascityfed.org/research/indicatorsdata/energy.

The Federal Reserve Bank of Kansas City serves the Tenth Federal Reserve District, encompassing the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming; and the northern half of New Mexico. As part of the nation’s central bank, the Bank participates in setting national monetary policy, supervising and regulating numerous commercial banks and bank holding companies, and providing financial services to depository institutions. More information is available online at www.kansascityfed.org.

Click on this link to read the energy report from January 10, 2020.

Highlights (JANUARY 10, 2020):

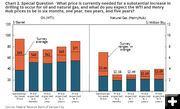

Fourth quarter energy survey results revealed Tenth District energy activity dropped further and expectations for future activity continued to decline. Firms reported that oil prices needed to be on average $65 per barrel for substantial increases in drilling to occur, down slightly from six months ago but higher than both current prices and prices expected over the next year.

This quarter firms were asked what oil and natural gas prices were needed on average for a substantial increase in drilling to occur (in alternate quarters they are asked what price they need to be profitable on average across the fields in which they are active). The average oil price needed was $65 per barrel, with a range of $38 to $94. This average was below the price reported in the second quarter of 2019, but up slightly from the fourth quarter of 2018. The average natural gas price needed was $3.66 per million Btu, with responses ranging from $2.75 to $7.00.

Tenth District energy activity dropped further in the fourth quarter of 2019, as indicated by firms contacted between December 16th and December 31st, 2019. The drilling and business activity index fell from -23 to -48, indicating a continued, significant decrease in activity following a slight expansion earlier in 2019. However, the revenues index improved slightly, the wages and benefits index remained positive, and the employment index was flat. The supplier delivery time, profits, employee hours, and access to credit indexes all declined.

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices were slightly higher than Q3 2019, but similar to Q1 2019 price expectations. The average expected WTI prices were $60, $62, $65, and $71 per barrel, respectively. Expectations for natural gas prices decreased from last quarter. The average expected Henry Hub natural gas prices were $2.38, $2.49, $2.69, and $3.09 per million Btu, respectively.

Firms were also asked about their cash flow expectations for 2020 compared to 2019 (Chart 3). Nearly 37 percent of surveyed firms indicated they anticipate higher cash flow for 2020 compared to 2019, while 33 percent expect it will be down, and 30 percent expect no material change.

Finally, respondents were asked in what quarter they expect the U.S. rig count to begin rising again (Chart 4). Over 20 percent predicted an uptick in rig counts in Q2 2020 and 25 percent expected the U.S. rig count to increase in Q3 2020. However, over 33 percent reported they do not believe the rig count will increase in 2020 and listed timeframes extending into 2021 or later.

|